- Home

- Markets

- Who We Are

- Mission

- Services

- Newsletters

- Livestock Sales/Services/Sources

- Ag Links

- Contact Us

- Livestock Overview

- Market Overview

- Futures

- Options

- Charts

- Historical Data

- Market Heat Maps

- AgPlus

- Cash Bids By Zip

Is Microchip Technology Stock Underperforming the S&P 500?

/Microchip%20Technology%2C%20Inc_%20HQ%20sign-by%20Michael%20Vi%20via%20Shutterstock.jpg)

Chandler, Arizona-based Microchip Technology Incorporated (MCHP) develops, manufactures, and sells smart, connected, and secure embedded control solutions. With a market cap of $34.9 billion, the company's operations span various countries in the Americas, Europe, and Asia.

Companies worth $10 billion or more are commonly referred to as “large-cap stocks,” and Microchip fits the bill perfectly. Given the company’s extensive operations and influence in the chip industry, its valuation above this mark is unsurprising.

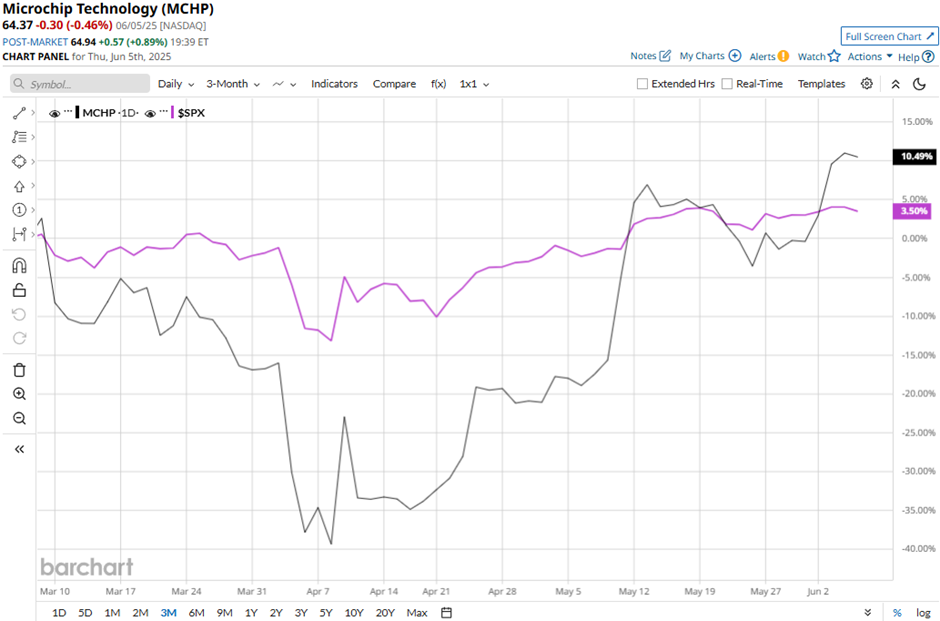

Despite its strengths, the stock has plunged 33.6% from its 52-week high of $96.98 touched on Jul. 17, 2024. However, over the past three months, MCHP stock has soared 7.9%, outpacing the S&P 500 Index’s ($SPX) 1.7% uptick during the same time frame.

MCHP stock has gained 12.2% on a YTD basis, notably outperforming SPX’s marginal 98 bps uptick in 2025. Meanwhile, MCHP has tanked 31.7% over the past 52 weeks, significantly underperforming SPX’s 10.9% gains.

To confirm the bearish trend, MCHP has mostly been below its 200-day moving average since early August 2024 and below its 50-day moving average since mid-July 2024, with some fluctuations in recent months.

Microchip Technology’s stock prices soared 12.6% in the trading session after the release of its better-than-expected Q4 results on May 8. The company’s net sales for the quarter plunged 26.8% year-over-year and 5.4% compared to Q3 to $970.5 million. However, the figure surpassed the Street’s expectations and management guidance by a notable margin. Moreover, the company’s non-GAAP net income for the quarter plummeted 80.2% year-over-year to $61.4 million, but its adjusted EPS of $0.11 surpassed the consensus estimates by 28.6%, which boosted investor confidence.

MCHP has also underperformed its peer Micron Technology, Inc.’s (MU) 26.3% surge on a YTD basis and 20.5% decline over the past 52 weeks.

Nevertheless, analysts remain bullish on the stock’s prospects. Among the 21 analysts covering the MCHP stock, the consensus rating is a “Strong Buy.” As of writing, the stock is trading above its mean price target of $63.76.

On the date of publication, Aditya Sarawgi did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.